wyoming property tax rate

058 of home value Tax amount varies by county The median property tax in Wyoming is 105800 per year for a home worth. Currently the level of assessment is 100 for gross production of minerals and mine products 115 for industrial use property and 95 for residential and all other real and personal.

058 of home value Tax amount varies by county The median property tax in Wyoming is 105800 per year for a home worth.

. Cheyenne Property Taxes Range. Click the link below to access the Tax Bill Lookup. Clients are often charged a percentage based.

On the left hand side of the screen click on Tax Information Search Enter your search criteria either last name address or parcel number. One mill is equal to 1 of tax for every 1000 in assessed value. You can look up your.

Wyoming Property Taxes Go To Different State 105800 Avg. The market value multiplied by the. Wisconsin The median property tax in Wyoming is 105800 per year based on a median home value of 18400000 and a median effective property tax rate of 058.

The median property tax in Lincoln County Wyoming is 915 per year for a home worth the median value of 196400. Property Tax Payment and Inquiry. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property.

So for example if your assessed value is 10000 and your. The states average effective property tax rate is just 057 which is good for 10th-lowest nationwide. The mission of the property tax division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property.

Wyomings tax system ranks. You will be assessed only on a portion of your propertys total value. 2021 Property Tax Refund Program Brochure.

2021 Median Property Tax Calculations. Wyoming Property Taxes Range Wyoming Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may not know. 2021 Median Household Income.

The average property tax rate is only 057 making Wyoming the lowest property tax taker. The assessed value will equal 95 of. Wyoming is a tax-friendly state for homeowners.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. What is the average price per acre of land in Wyoming. Based on latest data from the US Census Bureau.

Properties displaying a difference with tax assessed being 10 percent or more over the samplings median level will be selected for more analysis. Property Tax Exemptions Relief or Refund Programs. Wyoming ranks in 10th position in the USA for taking the lowest property tax.

The average Wyoming property tax bill adds up to 1349 which. Cheyenne Property Taxes Range. Lincoln County collects on average 047 of a propertys assessed.

Wyoming Property Taxes Go To Different State 105800 Avg. Homeowners pay 567 for every 1000 of home value in property taxes. Property Tax Sale The next Tax Sale is scheduled for August.

Average Property Tax Rate in Cheyenne. The Assessment Rate is 95 for agricultural commercial and residential property 115 for industrial and 100 for minerals. Back to Administrative Services Division.

Property tax rates in Wyoming are expressed as mills. Once the tax is determined it is the duty of the County Treasurer to collect taxes.

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Wyoming Taxes Wy State Income Tax Calculator Community Tax

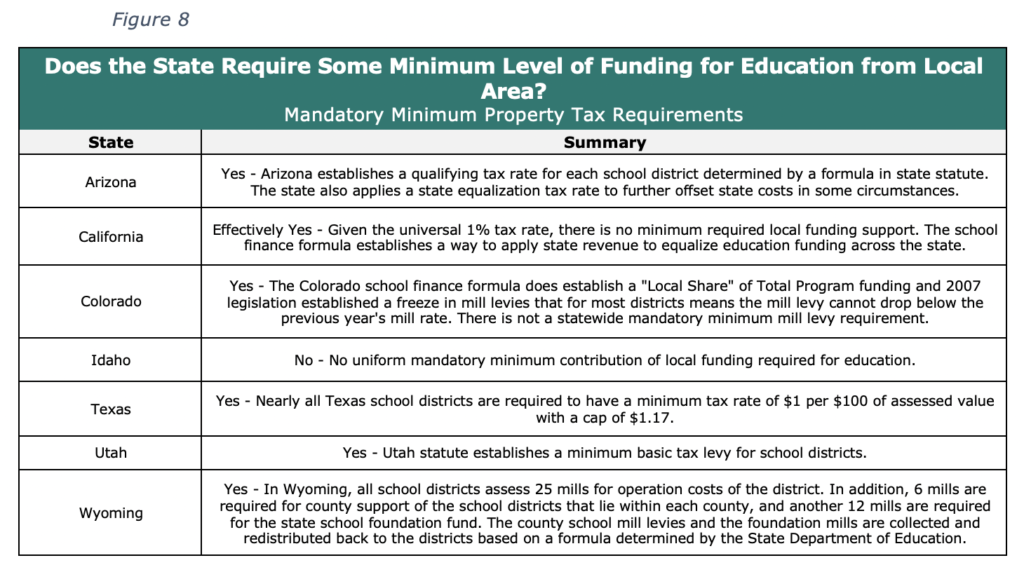

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Why Wyoming May Be The Ideal Place For Retirement

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

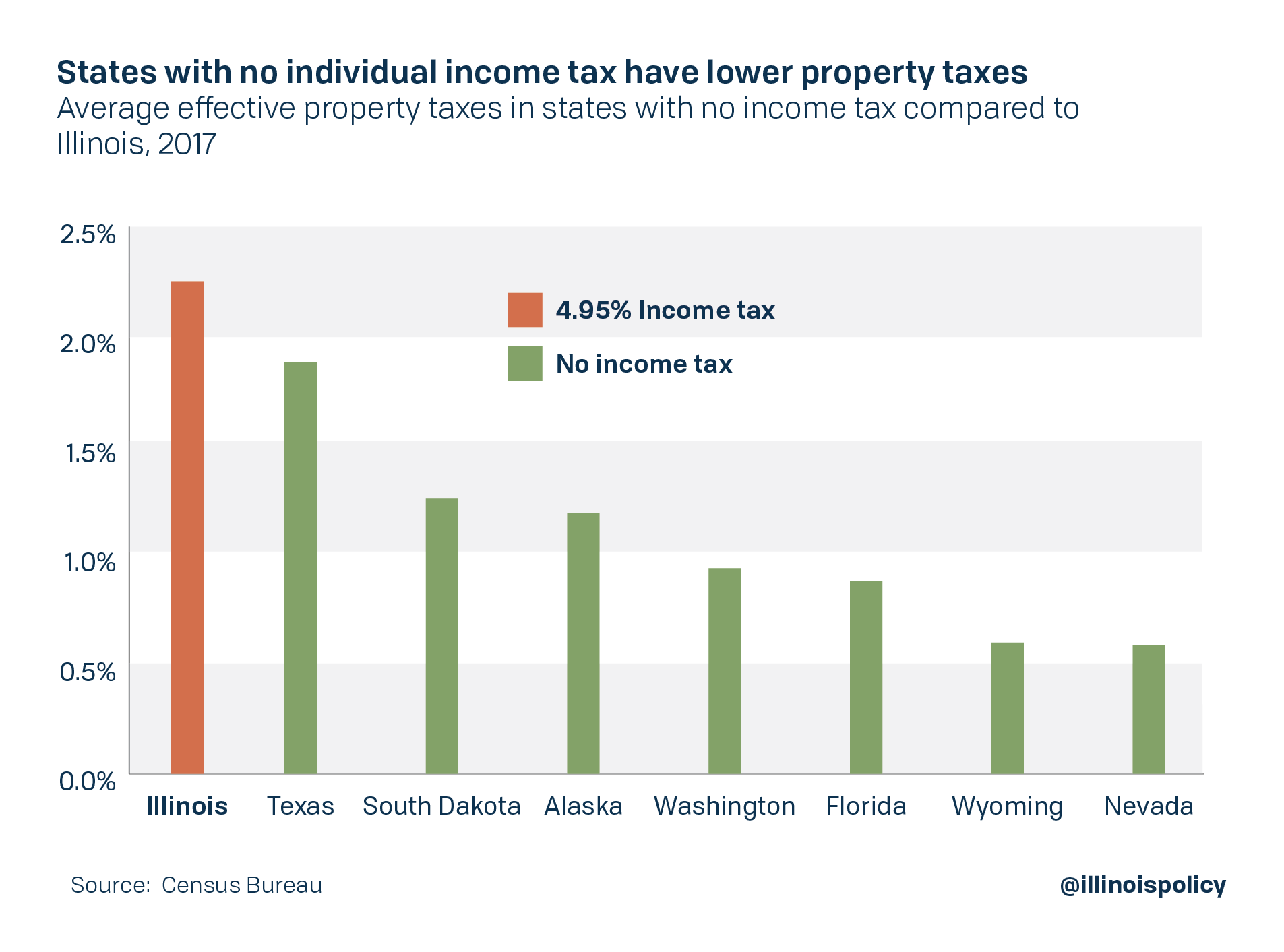

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

How Do State And Local Property Taxes Work Tax Policy Center

States That Have No Income Tax

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

10 States With The Lowest Property Taxes

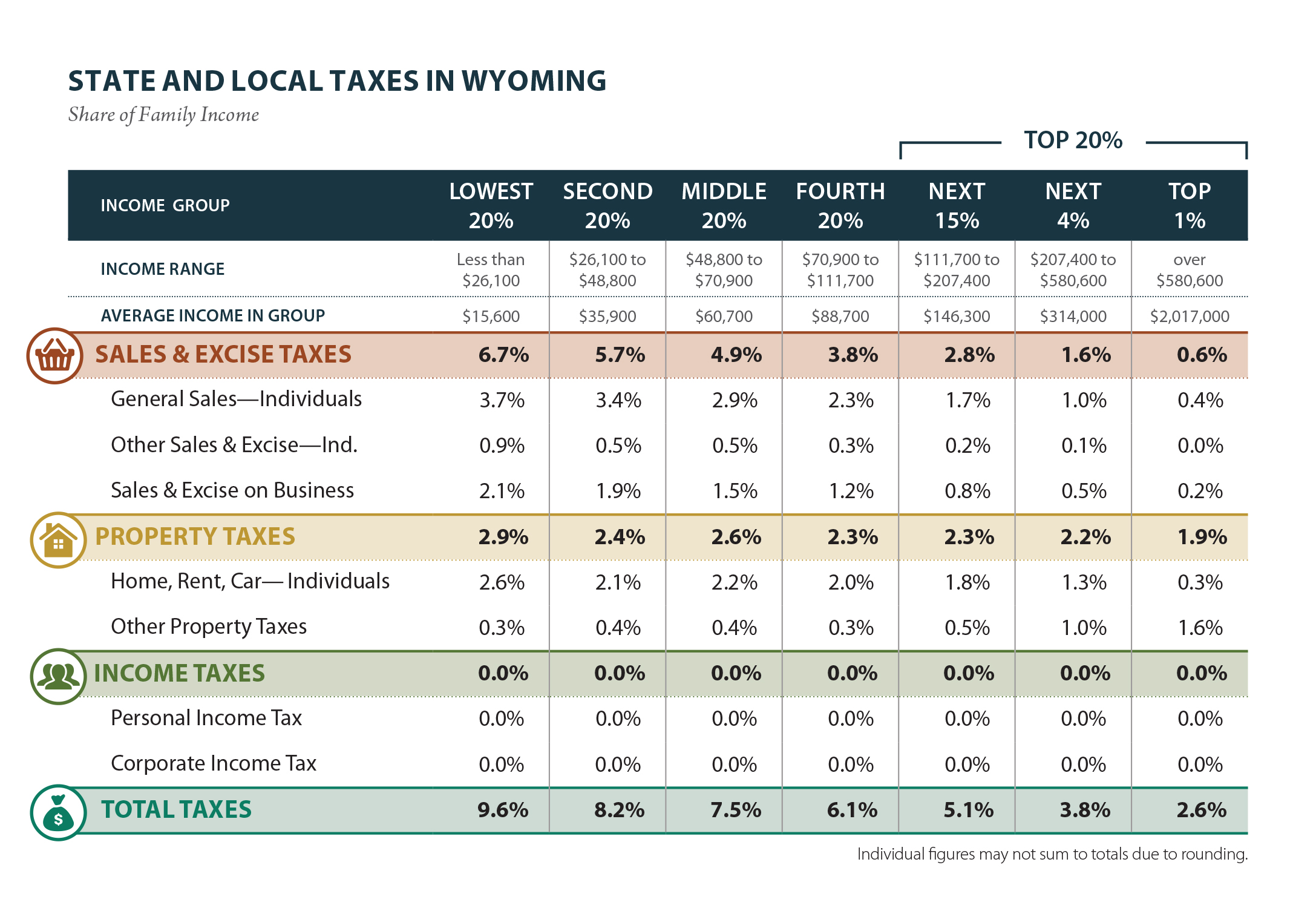

Wyoming Who Pays 6th Edition Itep

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

A Breakdown Of 2022 Property Tax By State

Wyoming State Economic Profile Rich States Poor States

The Official Website Of Platte County Wyoming Property Tax Information

Historical Wyoming Tax Policy Information Ballotpedia

Property Taxes By State In 2022 A Complete Rundown

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)